Frequently Asked Questions

You’ve got questions and we’ve got answers. If we don’t cover it below, don’t hesitate to contact us.

How are you different from everyone else?

We have licensed Brokers on staff. We are BBB accredited. We’re also heavily involved in the community. These three things mean that we hold ourselves to the highest standards of professional conduct.

Will you be listing my house on the MLS or actually buying it?

We are actual local cash buyers. We buy houses in Nationwide that meet certain criteria. We personally hold rental portfolios, work with other investors, as well as first-time home buyers.

Do you pay fair prices for properties?

Yes. Our philosophy is rooted in creating mutually beneficial transactions to better our communities. Our offers are based upon comparable sales of properties in like condition.

How do you determine the price to offer on my house?

We analyze the location, condition of the property, and comparable sales. Have you received offers from “We buy houses” companies that didn’t make sense? Give us a call and let us show you how we’re a cut above the rest.

Is there any obligation when I submit my info?

None. We want to educate you on your options. The end decision lies completely on you, your family, and your timeframe.

Are there any fees or commissions to work with you?

No. When we make you an offer, we cover all of the closing costs, doc fees, and even the title companies cut. (This will all be covered in your Purchase & Sale Agreement.)

How is selling to a cash home buyer different from a traditional real estate agent sale?

Cash buyers offer a faster, simpler process by purchasing homes as-is without the need for repairs, showings, or financing contingencies. Traditional agent sales take longer and may require home preparation, inspections, and paying commissions.

What types of properties do you buy?

We buy all property types, including houses, condos, townhomes, land, mobile homes, and commercial properties—regardless of condition, from move-in ready to needing extensive repairs or renovations.

Can I sell my house if I am behind on mortgage payments or have liens?

Yes, as long as the sale price covers all outstanding debts, we can help negotiate with lenders and facilitate a smooth sale even in challenging financial situations.

How long does the entire selling process take?

Offers can be made within 24-48 hours after evaluation, with closings possible in as little as 7-14 days or with a timeline that fits your needs.

What happens if I live out of state or cannot do an in-person walkthrough?

We accommodate remote sellers via photos, videos, or virtual walkthroughs, enabling a convenient, secure, and streamlined process without travel.

Are there obligations or risks after I submit my property information?

No. You are under no obligation to accept our offer or proceed. We provide transparent, no-pressure communication so you can make the best decision.

How will I receive my money?

Funds are typically wired to your bank account the business day after escrow closes, ensuring a secure and timely transaction.

Want To See What We Can Do for You?

Fill Out the Quick Form Below to Get a Cash Offer!

RjRebel Real Estate Investments, LLC

(888) 519-5211

How to Handle Expensive Repairs When Selling or Investing in Property

How to Handle Expensive Repairs When Selling or Investing in Property

- Why Expensive Repairs Can Be a Major Challenge

- Common Types of Costly Repairs

- Strategies to Manage or Avoid Expensive Repairs

- Selling “As-Is” vs. Repairing Before Sale

- Financing Options for Repairs

- How Investors Approach Properties with Expensive Repairs

- Conclusion and Actionable Tips

How to Handle Expensive Repairs When Selling or Investing in Property

Expensive repairs can quickly turn a promising property opportunity into a financial headache for both homeowners and real estate investors. Whether you’re facing a home that needs a new roof, outdated electrical wiring, or major structural work, understanding how to navigate these costly repairs can save you time, money, and stress.

Why Expensive Repairs Can Be a Major Challenge

When repair costs climb into the thousands, many sellers hesitate to invest upfront, fearing they won’t get their money back in the sale. Investors also weigh repair expenses heavily since they affect profit margins and timelines. Without a plan, these costly fixes can derail deals or lead to unexpected financial strain.

Common Types of Costly Repairs

Some of the most expensive repairs include:

- Roof replacement or major repairs

- Foundation issues and structural damage

- Plumbing and sewer system upgrades

- Electrical rewiring or panel replacement

- HVAC system replacements

- Mold remediation or water damage repairs

Each can range from several thousand to tens of thousands of dollars, depending on the severity.

Strategies to Manage or Avoid Expensive Repairs

- Sell “As-Is”: Many investors specialize in buying properties without requiring sellers to make repairs, taking the property in its current condition. This can be a blessing if you want to avoid upfront costs or speed up your sale.

- Get Multiple Repair Estimates: Before deciding, it’s smart to get quotes from several contractors to find the best price and scope.

- Negotiate Repair Credits with Buyers: Sometimes buyers agree to purchase the home with repair costs factored into the price, giving you flexibility.

Selling “As-Is” vs. Repairing Before Sale

If time and money permit, fixing major issues before listing can increase your home value and buyer appeal. However, some repairs are better left to investors or buyers with renovation experience, especially if you want a quick sale.

Financing Options for Repairs

Homeowners and investors alike may access funding, such as:

- Home equity lines of credit (HELOC)

- Renovation loans (FHA 203k, Fannie Mae HomeStyle)

- Personal loans or credit lines

It’s important to evaluate the cost of borrowing versus potential returns on repair investments.

How Investors Approach Properties with Expensive Repairs

Savvy investors calculate repair costs upfront and factor them into their offer price. Many target “fixer-upper” homes precisely because they can add value through renovations, but only when the numbers make sense.

Conclusion and Actionable Tips

Facing expensive repairs can be stressful, but it doesn’t have to stall your real estate goals. Whether you sell as-is, finance repairs, or partner with investors, knowing your options empowers better decisions.

Action Steps:

- Get a professional inspection to understand repair needs

- Obtain multiple bids to compare costs

- Consider selling as-is if repair costs are unaffordable

- Explore financing options if repairs can add value

- Consult a real estate professional for tailored advice

If you’re struggling with costly repairs or want to explore your selling options, contact us today for a free consultation.

Get A Cash Offer | Contact Us | How It Works | FAQ | Our Company | Resources | Privacy Policy | Blog

RjRebel Real Estate Investments, LLC

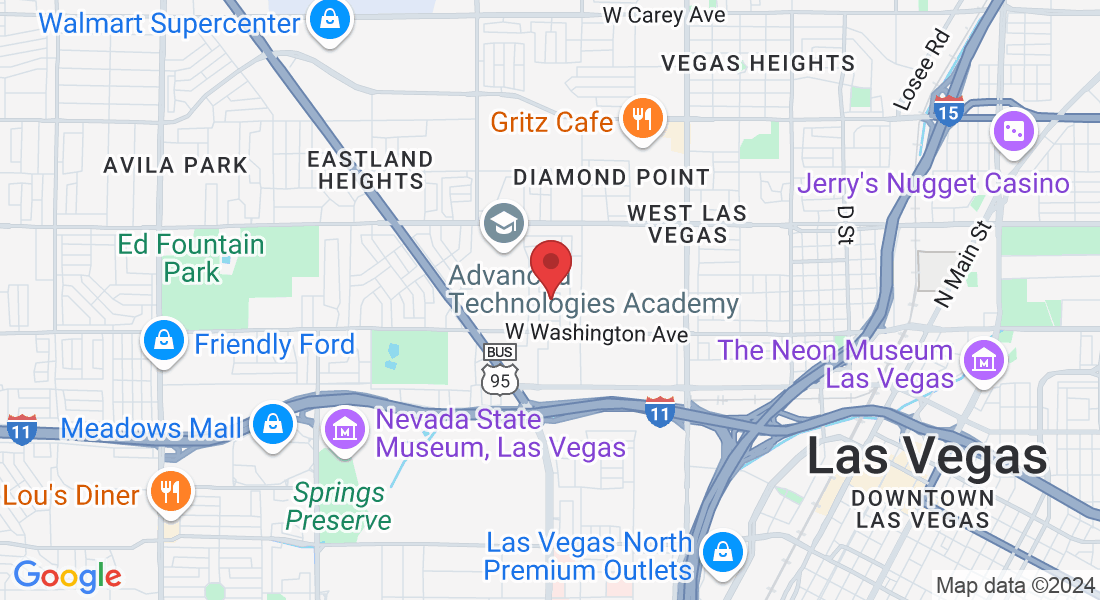

2208 Fair Ave, Las Vegas NV 89106

We are a Real Estate services company. We can assist you with anything Real Estate related. We are unlike any other company you have spoken with. We actually make offers, pay cash, and have other solutions. We will analyze your situation and determine what is the best possible solution. It may be listings on the market, selling as is, or renting the property out. Regardless of the situation we would love to sit down with you for a complimentary consultation.

www.rjrebelrealestateinvestments.com | Sitemap

Copyright 2019 - 2025 RjRebel Real Estate Investments, LLC (888) 519-5211 - All Rights Reserved

Powered by ClientPro.ai