Frequently Asked Questions

You’ve got questions and we’ve got answers. If we don’t cover it below, don’t hesitate to contact us.

How are you different from everyone else?

We have licensed Brokers on staff. We are BBB accredited. We’re also heavily involved in the community. These three things mean that we hold ourselves to the highest standards of professional conduct.

Will you be listing my house on the MLS or actually buying it?

We are actual local cash buyers. We buy houses in Nationwide that meet certain criteria. We personally hold rental portfolios, work with other investors, as well as first-time home buyers.

Do you pay fair prices for properties?

Yes. Our philosophy is rooted in creating mutually beneficial transactions to better our communities. Our offers are based upon comparable sales of properties in like condition.

How do you determine the price to offer on my house?

We analyze the location, condition of the property, and comparable sales. Have you received offers from “We buy houses” companies that didn’t make sense? Give us a call and let us show you how we’re a cut above the rest.

Is there any obligation when I submit my info?

None. We want to educate you on your options. The end decision lies completely on you, your family, and your timeframe.

Are there any fees or commissions to work with you?

No. When we make you an offer, we cover all of the closing costs, doc fees, and even the title companies cut. (This will all be covered in your Purchase & Sale Agreement.)

How is selling to a cash home buyer different from a traditional real estate agent sale?

Cash buyers offer a faster, simpler process by purchasing homes as-is without the need for repairs, showings, or financing contingencies. Traditional agent sales take longer and may require home preparation, inspections, and paying commissions.

What types of properties do you buy?

We buy all property types, including houses, condos, townhomes, land, mobile homes, and commercial properties—regardless of condition, from move-in ready to needing extensive repairs or renovations.

Can I sell my house if I am behind on mortgage payments or have liens?

Yes, as long as the sale price covers all outstanding debts, we can help negotiate with lenders and facilitate a smooth sale even in challenging financial situations.

How long does the entire selling process take?

Offers can be made within 24-48 hours after evaluation, with closings possible in as little as 7-14 days or with a timeline that fits your needs.

What happens if I live out of state or cannot do an in-person walkthrough?

We accommodate remote sellers via photos, videos, or virtual walkthroughs, enabling a convenient, secure, and streamlined process without travel.

Are there obligations or risks after I submit my property information?

No. You are under no obligation to accept our offer or proceed. We provide transparent, no-pressure communication so you can make the best decision.

How will I receive my money?

Funds are typically wired to your bank account the business day after escrow closes, ensuring a secure and timely transaction.

Want To See What We Can Do for You?

Fill Out the Quick Form Below to Get a Cash Offer!

RjRebel Real Estate Investments, LLC

(888) 519-5211

Downsizing or Retiring: How to Simplify Your Real Estate and Secure Your Future

Downsizing or Retiring: How to Simplify Your Real Estate and Secure Your Future

Outline:

Introduction

Why Downsizing or Retiring Often Means Selling Your Home

Financial and Emotional Benefits of Downsizing

Key Considerations When Choosing a New Home

How to Prepare Your Current Home for Sale

Selling Options for Seniors and Retirees

Tips for a Smooth Transition

Conclusion and Next Steps

Full Blog Article:

Downsizing or Retiring: How to Simplify Your Real Estate and Secure Your Future

For many, downsizing or entering retirement is more than just a lifestyle decision—it’s an opportunity to simplify, reduce expenses, and focus on what matters most. Whether you’re ready to move to a smaller home, a retirement community, or sell your investment property, understanding the real estate implications can help you transition smoothly and securely.

Why Downsizing or Retiring Often Means Selling Your Home

As you shift into retirement or seek a simpler life, maintaining a large home can become financially and physically burdensome. Selling your current property allows you to access equity, reduce property taxes, maintenance costs, and free up resources to enjoy your retirement years.

Financial and Emotional Benefits of Downsizing

Downsizing can help you:

Increase disposable income for travel, healthcare, or hobbies

Lower home maintenance and utility costs

Simplify daily living with a more manageable space

Reduce stress related to upkeep and responsibilities

Emotionally, some find relief and peace in letting go of a larger, more demanding property.

Key Considerations When Choosing a New Home

When downsizing or retiring, think about:

Accessibility and proximity to healthcare and family

Community amenities supporting your lifestyle

Maintenance expectations and fees if choosing condos or communities

Affordability and future-proofing for health and mobility needs

How to Prepare Your Current Home for Sale

Sellers looking to downsize or retire should:

Declutter and depersonalize the space

Address minor repairs or cosmetic updates to maximize appeal

Consider working with a real estate professional who understands senior sellers' unique needs

Price competitively for a timely sale

Selling Options for Seniors and Retirees

If convenience and speed are priorities, selling to a trusted cash buyer can be an excellent alternative. This option allows you to:

Sell as-is without repairs or staging

Avoid lengthy listing periods and showings

Close quickly and use proceeds to support retirement living

Tips for a Smooth Transition

Plan your timeline carefully to coordinate buying and selling

Seek advice from financial and legal professionals, especially if estate planning is involved

Communicate openly with family about your plans and needs

Use professional movers or senior relocation specialists if needed

Conclusion and Next Steps

Downsizing or retiring is a significant life change that comes with many benefits when well planned. Whether you decide to sell traditionally or pursue a cash sale, preparing your home and choosing the right approach ensures a smooth, stress-free transition.

If you’re considering downsizing or retirement and want expert guidance or a fair cash offer, contact us today for a free consultation.

Get A Cash Offer | Contact Us | How It Works | FAQ | Our Company | Resources | Privacy Policy | Blog

RjRebel Real Estate Investments, LLC

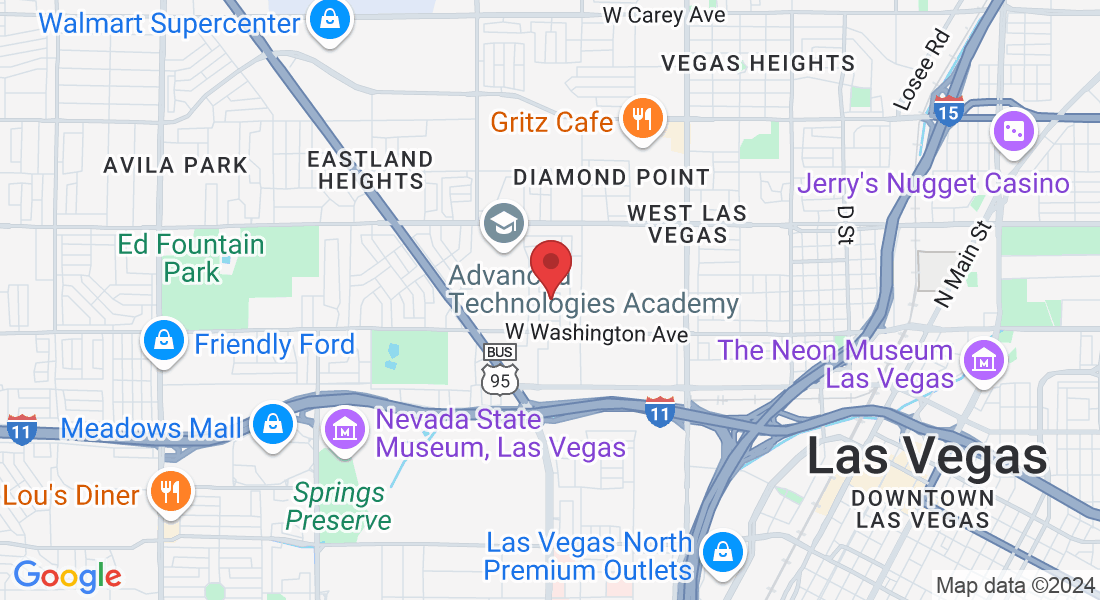

2208 Fair Ave, Las Vegas NV 89106

We are a Real Estate services company. We can assist you with anything Real Estate related. We are unlike any other company you have spoken with. We actually make offers, pay cash, and have other solutions. We will analyze your situation and determine what is the best possible solution. It may be listings on the market, selling as is, or renting the property out. Regardless of the situation we would love to sit down with you for a complimentary consultation.

www.rjrebelrealestateinvestments.com | Sitemap

Copyright 2019 - 2025 RjRebel Real Estate Investments, LLC (888) 519-5211 - All Rights Reserved

Powered by ClientPro.ai