Frequently Asked Questions

You’ve got questions and we’ve got answers. If we don’t cover it below, don’t hesitate to contact us.

How are you different from everyone else?

We have licensed Brokers on staff. We are BBB accredited. We’re also heavily involved in the community. These three things mean that we hold ourselves to the highest standards of professional conduct.

Will you be listing my house on the MLS or actually buying it?

We are actual local cash buyers. We buy houses in Nationwide that meet certain criteria. We personally hold rental portfolios, work with other investors, as well as first-time home buyers.

Do you pay fair prices for properties?

Yes. Our philosophy is rooted in creating mutually beneficial transactions to better our communities. Our offers are based upon comparable sales of properties in like condition.

How do you determine the price to offer on my house?

We analyze the location, condition of the property, and comparable sales. Have you received offers from “We buy houses” companies that didn’t make sense? Give us a call and let us show you how we’re a cut above the rest.

Is there any obligation when I submit my info?

None. We want to educate you on your options. The end decision lies completely on you, your family, and your timeframe.

Are there any fees or commissions to work with you?

No. When we make you an offer, we cover all of the closing costs, doc fees, and even the title companies cut. (This will all be covered in your Purchase & Sale Agreement.)

Want To See What We Can Do for You?

Fill Out the Quick Form Below to Get a Cash Offer!

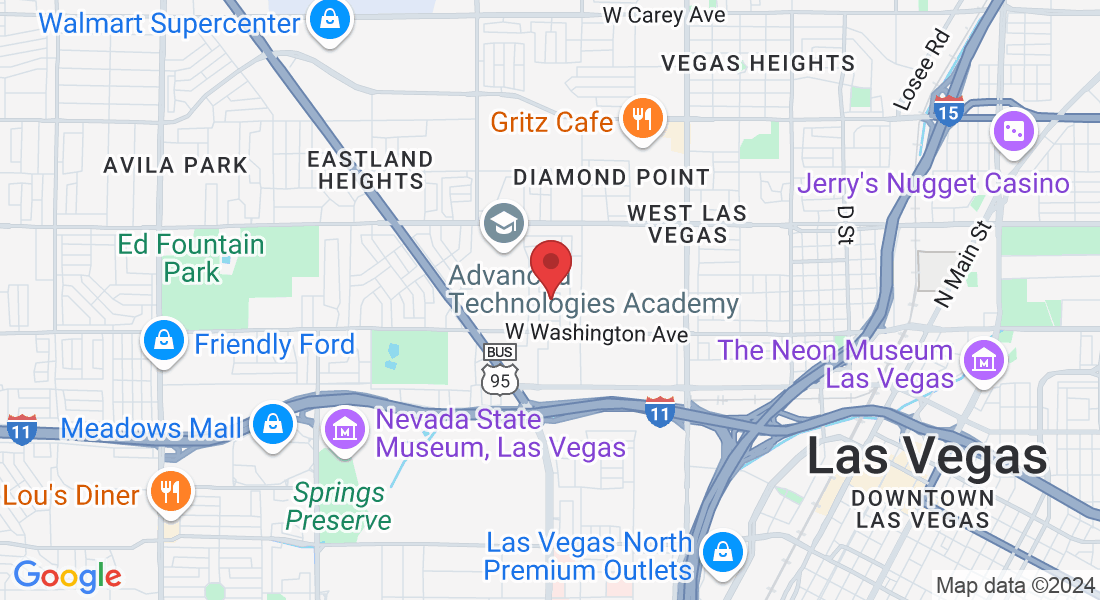

RjRebel Real Estate Investments, LLC

(888) 519-5211

What Rising Foreclosure Rates Mean for Home Buyers and Sellers in South Carolina

It’s no secret that foreclosure rates in America are on the rise. This can affect the South Carolina real estate market in all sorts of ways. The housing market has always been a volatile industry. With fluctuating prices, ever-changing regulations, and unforeseeable economic conditions, it can be challenging for homebuyers and home sellers to navigate the market successfully. One of the most significant factors that can impact the housing market is foreclosure rates. When foreclosure rates rise, it can have a significant impact on both homebuyers and home sellers. Are you thinking of buying or selling a house in South Carolina? Here’s what rising foreclosure rates may mean for you.

What is Foreclosure?

Foreclosure rates are a measure of the number of homes that have been repossessed by lenders due to the homeowner’s inability to pay their mortgage. When foreclosure rates rise, it can indicate an economic downturn, a rise in unemployment rates, or an increase in interest rates. Regardless of the cause, rising foreclosure rates can lead to a drop in home prices, which can impact both home buyers and home sellers.

How Foreclosures Impact Home Buyers in South Carolina

For homebuyers, rising foreclosure rates can be both a blessing and a curse. On the one hand, it can mean that there are more affordable homes on the market. Foreclosed homes are often sold at a discount, making them an attractive option for homebuyers on a budget. However, foreclosed homes can also come with a lot of baggage. Many foreclosed homes are in disrepair, and the previous owners may have neglected them or stripped them of valuable fixtures and appliances. Additionally, buying a foreclosed home can be a lengthy and complicated process, as the bank or lender that repossessed the home will need to approve the sale.

How Foreclosures Impact Home Sellers in South Carolina

For home sellers, rising foreclosure rates can be a cause for concern. As more homes are foreclosed upon, there may be an increase in the number of distressed sales on the market. Distressed sales are when a seller is forced to sell their home quickly, often at a loss, due to financial hardship. These sales can drive down home prices in the area, making it harder for other sellers to get the price they want for their homes. Additionally, if a home seller is facing foreclosure themselves, they may be forced to sell their home at a loss to avoid losing it to the bank.

What You Can Do

Ultimately, rising foreclosure rates can impact both home buyers and home sellers in different ways. However, there are steps that both parties can take to navigate the market successfully during these challenging times.

Making an Offer on a Foreclosed Home

For homebuyers, it’s important to do your research before making an offer on a foreclosed home. Work with a real estate agent who has experience in the foreclosure market, and be prepared for a potentially lengthy and complicated process. Make sure to get a thorough inspection of the property before making an offer, and be prepared to invest time and money into repairs and renovations if necessary.

How Sellers Can Stay Competitive

For home sellers in South Carolina, it’s essential to stay competitive in the market. This may mean pricing your home competitively or making necessary repairs and upgrades to attract buyers. Additionally, if you’re facing foreclosure, it’s important to work with your lender to explore all of your options. This may include a short sale, where you sell your home for less than what you owe on your mortgage, or a loan modification, where your lender adjusts the terms of your mortgage to make it more affordable.

How Cash Home Buyers Can Help

Cash Home Buyers is unique in that we work with both buyers and sellers to facilitate deals in which everyone comes out ahead. We help local homeowners by offering a great price for their homes, stopping the foreclosure process almost immediately. Instead of losing their homes to the bank, homeowners are able to walk away from the frustrating property with a check in hand.

Rising foreclosure rates can be a cause for concern for both home buyers and home sellers. However, with careful research, preparation, and strategic decision-making, it’s possible to navigate the market successfully during these challenging times. Whether you’re looking to buy or sell a home, it’s important to work with a trusted real estate agent who can guide you through the process and help you make informed decisions. With the right approach, you can achieve your homeownership goals, even in the face of rising foreclosure rates.

Foreclosure rates are up since the pandemic, but Cash Home Buyers is here to offer solutions. We can help homeowners sell before the foreclosure process begins. We can also help foreclosure buyers by finding properties and facilitating deals. To learn more about us and what we can offer don’t hesitate to reach out! We’re happy to answer any questions you have about foreclosure properties in South Carolina. (803) 889-0840

Get A Cash Offer | Contact Us | How It Works | FAQ | Our Company | Resources | Privacy Policy | Blog

RjRebel Real Estate Investments, LLC

We are a Real Estate services company. We can assist you with anything Real Estate related. We are unlike any other company you have spoken with. We actually make offers, pay cash, and have other solutions. We will analyze your situation and determine what is the best possible solution. It may be listings on the market, selling as is, or renting the property out. Regardless of the situation we would love to sit down with you for a complimentary consultation.

www.rjrebelrealestateinvestments.com | Terms | Privacy

Copyright ©️ 2019 - RjRebel Real Estate Investments, LLC - All Rights Reserved

Powered by ClientPro.ai